Last Updated:

22/03/2025

WHAT IS STAMP DUTY?

Stamp duty is a tax imposed by state and territory governments on specific transactions and legal documents, such as the purchase of property, motor vehicles, or certain insurance policies. When you buy a property or someone transfers ownership of a property to you in NSW, you generally must pay transfer duty (stamp duty).

INTRODUCTION TO STAMP DUTY

You must pay transfer duty – once known as stamp duty – in NSW when you buy:

-

property, including your home or holiday home

-

an investment property

-

vacant land or a farming property

-

commercial or industrial properties,

-

or a business, which includes land.

You must also pay transfer duty when you acquire land, or an interest in land, without buying it. For example:

-

a declaration of trust

-

a gift, or

-

a transaction effecting a change in the beneficial ownership of a property.

In some circumstances, you may be eligible for a concession or exemption from transfer duty, such as:

-

when you are a beneficiary of a deceased estate, or

-

the transfer is between a married couple or de facto couple.

SURCHARGE PURCHASER DUTY

From 21 June 2016, if you are considered a foreign person and are acquiring residential-related property NSW, you must pay surcharge purchaser duty. Surcharge purchaser duty is calculated on the dutiable value and is paid in addition to the transfer duty payable on the acquisition of residential-related property. Refer to surcharge purchaser duty for more information.

WHEN TO PAY TRANSFER DUTY

You must pay transfer duty within three months of signing the contract for sale, or transfer if there is no contract.

However, settlement cannot take place if transfer duty has not been paid. This means that if settlement is earlier, duty must be paid on or before the date of settlement.

If you buy off-the-plan and you intend to live in the property, you may be able to defer the payment of your transfer duty for up to 12 months.

CALCULATING STAMP DUTY

You must pay transfer duty based on the property’s sale price or its current market value, whichever is higher.

Standard Transfer Duty Calculations - From 1 July 2025

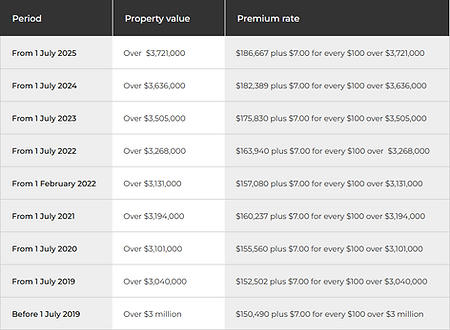

Premium Transfer Duty Calculations

PAY YOUR TRANSFER DUTY

Your solicitor or conveyancer can lodge an application for assessment on a contract for sale or transfer of land on your behalf. They’ll also arrange for duty to be paid. This is typically done as part of the settlement process. They'll also know if you are entitled to any exemptions or concessions. If you’re not using a solicitor or conveyancer, you must lodge an application and pay duty yourself.

BUSINESS TRANSACTIONS

From 1 July 2016, the NSW government abolished transfer duty on the sale of business assets, including intellectual property, goodwill and statutory licences. However, you still must pay transfer duty on any land the business holds. Duty will be assessed on the value of the land, including leasehold interests, fixtures and goods. If you're transferring or assigning a lease not connected to any business assets, complete the declaration for urgent stamping of transfers and assignment of leases form.